Q2 2023

Kinsman Oak Investor Letter Q2 2023

July 18, 2023

Click here to download the PDF version

COMMENT ON PERFORMANCE

The Fund had little trading activity during the quarter. Our underlying holdings performed in line with the broader market, and we were only surprised by how few surprises we actually had. We took an opportunity to add starter weights in two positions we believed were cheap enough on out-year earnings and would average down if they dipped below our cost. In hindsight, we should have initiated the positions at higher weights since they have both melted up along with the rest of the market.

MARKET COMMENTARY

The second quarter was a continuation of the first. Animal spirits this year have reversed compared to last and, aside from a fleeting moment of regional bank failure-induced panic, the stock market relentlessly marched higher. Volatility continues to fall, equity prices climb, and sentiment feels more bullish by the day. In our view, investors are pricing in a soft landing and very little, if any, margin of safety is embedded into valuations.

Year-to-date, the S&P 500 rally has experienced extraordinarily narrow breadth by historical standards. Nearly all the gains have been driven by only a handful of mega-cap technology stocks. The sudden revival of the technology sector in general reminds us of The Undertaker emerging from a coffin. Hype surrounding artificial intelligence put the regional banking crisis in the rearview mirror and that rally has broadened since mid-June.

The pace of inflation has slowed significantly across almost every key category. That said, the most recent dot plot shows the Federal Reserve still projects two additional quarter-point rate hikes this year. The message is clear: Getting inflation under control is one thing. Keeping it under control is another.

We often wonder if any handful of anointed individuals, no matter how smart they may be, are even capable of adequately wielding such power. Regardless, the tightrope they walk is obvious. Leaving interest rates too high for too long will make the inevitable recession worse. Cutting too soon could cause inflation to return. Assessing the path dependent probabilities of either scenario occurring, and then comparing the potential negative outcomes for each, is an unenviable position to be in.

Recessions and Inverted Yield Curves

Going forward, the biggest macroeconomic variable in the short-to-medium term is evaluating the odds of the next (and much-anticipated) U.S. recession. Traditional recession predictors have been flashing false-positive signals for quite some time, but aggregate measures of economic activity show little, if any, signs of weakness. This discrepancy further highlights the unusual nature of the current economic cycle.

The U.S. Treasury yield curve is widely considered to be the most reliable recession predictor and, when inverted, a recession typically begins on average 12-18 months later. The yield curve has been inverted since November 2022, so history suggests we should expect a recession in the first half of 2024. But what makes this red flag particularly notable is the staggering degree of the inversion. Statistically speaking, the 10-year T-Bond yield minus the 3-Month T-Bill yield is more than two standard deviations below historical average. The yield curve hasn’t been this inverted since the late 1970s-early 1980s (Appendix A).

It's worth noting inverted yield curves have accurately forecasted each recession over the past fifty years. Further, no recession has ever occurred in the absence of a yield curve inversion preceding it. The degree and duration of the negative spread is correlated to the severity of the recession that follows, which bodes poorly for the economy going forward. All of this suggests some level of caution is warranted but accurately calculating the lag is difficult, if not impossible, and the bigger question is how much pessimism is embedded into valuations today.

EYE OF THE STORM VS. DISINFLATIONARY SOFT LANDING

Narrative generally chases price action. A few months ago, market participants believed a regional banking crisis would wreak havoc on commercial real estate and small businesses, and the effects of which would catastrophically ripple through the rest of the economy. Fast forward to today. The S&P 500 has rallied almost 20% from March lows, immaculate disinflation is all but guaranteed, and Meriam Webster is almost poised to remove the word “recession” from the dictionary. We can’t say for sure, but the truth is probably somewhere in between, and the variables that cause us concern are an inverted yield curve, narrow breadth, and lofty AI valuations.

Narrow Breadth

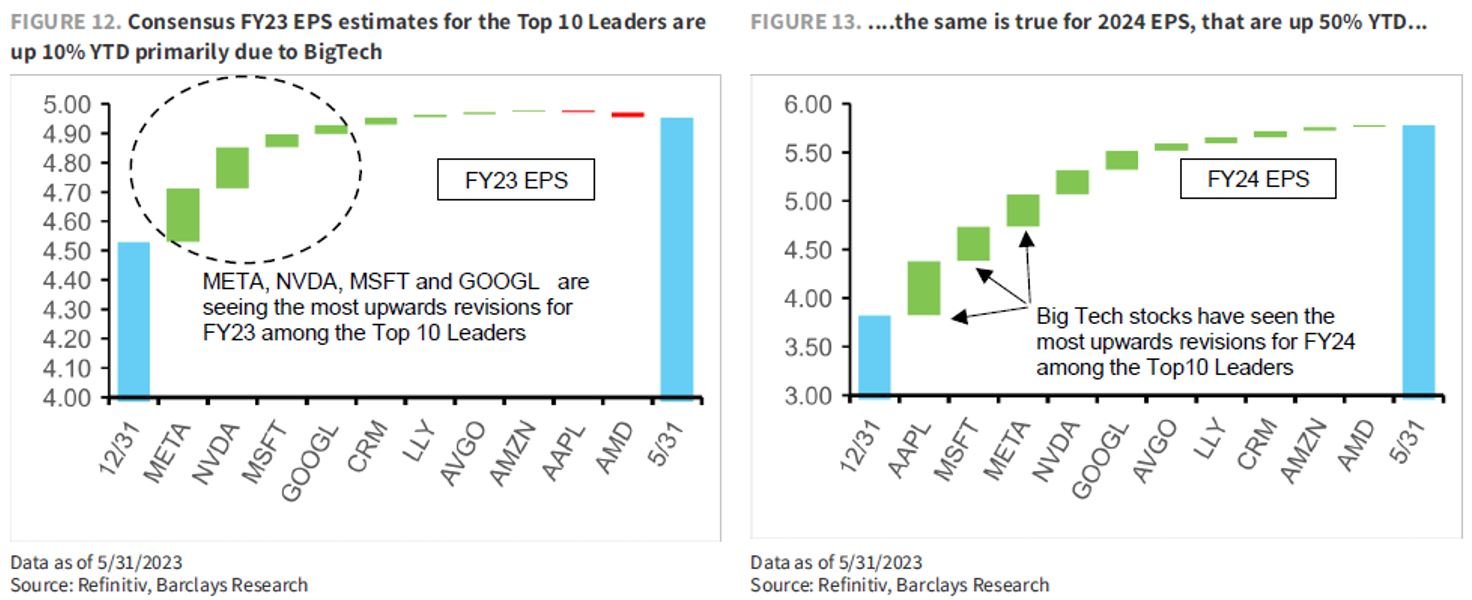

To say the S&P 500 performance over the first half of the year was incredibly narrow would be an understatement. As of mid-June, the proportion of returns attributable to the top 5 largest constituents was approximately 75% (!) of the index’s gain year-to-date, greater than any other year over the past two decades. The spread of returns between the haves (top 10 holdings) and the have-nots (the remaining 490) has only been this narrow during the dot-com bubble in 2000 and the COVID-19 rebound in 2020 (Appendix B).

Comparing the return profiles for the following indexes further illustrates our point: Nasdaq (NDQ) +39.3%; S&P 500 (SPX) +16.9%; Russell 2000 (RTY) +8.1%; Dow Jones (INDU) +4.9%. We believe a combination of underweight positioning heading into the year plus the hype surrounding AI has been a clear factor in equity return distribution. A handful of big technology companies drove the Nasdaq and S&P 500 higher while the Dow Jones was left behind. Sustainable bull markets typically have wide breadth. It remains to be seen whether these market leaders will give back their year-to-date gains or the remaining 490 stocks will close the gap as everything drifts higher.

Artificial Intelligence and Second-Level Thinking

Let us know if any of this sounds familiar. We are on the cusp of a revolutionary technological innovation that would have sounded like science fiction only a few years ago. Everything about it sounds promising and everybody is getting excited about it. Influential people are painting a vision for the future where its application could change numerous industries in unimaginable ways we couldn’t even begin to predict. New sectors would be created out of thin air. Old sectors would be put out of existence. Change is coming, and it’s coming quickly.

That’s artificial intelligence today, obviously. But it’s also the internet in the late 1990s. The lesson today is the same as it was back then. It’s not about the potential of a new technology. It’s ascertaining how much potential is already priced in. First-level thinking is figuring out how AI will change the world. Second-level thinking is more complex takes it one step further. For instance: How much optimism is embedded into prices today? And is that amount inadequate or excessive? Worth noting, a corporate name change and mentioning trendy buzzwords on earnings calls does not magically turn your business into an AI-exposed company, by the way.

Barclays basket of AI-levered stocks in the U.S. is up 50% year-to-date. Gains were almost entirely driven by valuation multiple expansion and these stocks have dragged the broader technology sector along for the ride while the rest of the SPX essentially flat (Appendix C). We are not industry experts, but we think there is a possibility that AI’s primary beneficiaries can potentially grow into their current valuations. However, these companies will be exceptions and the majority will not. It may also take these companies years, or even decades, to do so.

Cisco (CSCO) and Microsoft (MSFT) are perfect examples of winners from the dot-com bubble but, even then, it took these companies two decades of stellar execution to grow into their valuations. In our view, the biggest difference between the dot-com bubble and the AI hype train is most of the likely winners are already profitable businesses with deep moats in established industries.

We wonder if AI will lead to exponential growth and/or long-term structural corporate margin expansion which would help justify the premium valuations currently being placed on the perceived beneficiaries. For example, Nvidia (NVDA), trades for 43x LTM revenues and 221x trailing EPS. Valuing the stock has moved beyond financial modeling. Investors pile into it, trip over one another to accumulate an inelastic supply of shares, and then the narrative perpetuates a self-reinforcing cycle. There is no margin of safety. There is no discounted cash flow analysis.

CHANGING RETAIL LANDSCAPE

Numerous headwinds are contributing to weaker consumer spending. Households have been stretched by high inflation and, even if year-over-year trends moderate, they will remain strained given the accumulated effects of the inflation that has already taken place. Stimulus checks are a thing of the past. The personal savings rate has climbed from 3% to 4.6% in the last six months. Mortgage rates and credit availability are both trending in the wrong direction. Things appear bleak for the consumer discretionary sector, which means opportunity.

If you need more convincing, look no further than Amazon (AMZN) and Wayfair (W). Both businesses are aggressively cutting jobs and other expenses to right size their cost structures. The pandemic caused a drastic shift in spending patterns, transferring sales from in-person to online. It is no surprise that beneficiaries are now pulling back investment spend as consumer behaviour continues to renormalize. In our opinion, e-commerce and traditional retail sales will grow at a more similar rate going forward.

Plenty of strictly brick-and-mortar retailers have structurally broken business models. Plenty of online-only start-ups are opening physical stores to maximize sales. Businesses with one or the other are vulnerable. We think having a strong omnichannel presence will be the bare minimum to maintaining a legitimate competitive advantage (with the exception of Amazon). Businesses that can effectively sell products through both direct-to-consumer channels and third-party retailers will take share and maintain margins when discretionary spending rebounds.

We also believe investing through down cycles is important. Businesses that are overly focused on cutting costs will miss the bounce when the tide turns. Operationally speaking, they will have to re-hire the work force they previously fired and re-invest in sales and marketing, both of which take time. Great management teams, brands, and strategies typically come out of recessions as coiled springs. Stocks have significant upside potential as the industry rate of change inflects from negative to positive and the company is better competitively positioned to take market share within it. Forward estimates increase and valuation multiples expand.

On the flip side, competition has arguably never been tougher. There are simply fewer weak retailers today than anytime in the past. Behemoths like Amazon, Walmart, and Target have devoured the competitive landscape for years. Then the pandemic hit and served as an extinction level event for many businesses that were merely hanging on by a thread. The low-hanging fruit is gone, and these giants will be forced to compete more directly with one another. We suspect taking market share will be far more challenging as a result.

BAD REPURCHASE PROGRAMS

Stock buybacks are a major element of almost every famous capital allocation story. The value creation potential, especially when applied over long periods of time, is astronomical. AutoZone (AZO) is a textbook example. Since 1998, the company has repurchased 88% of total shares outstanding. Over that time, revenues increased 5x, net income increased 11x, and EPS increased 94x (not a typo). The stock has gone from $27 to $2,545 which illustrates that the compounding was not a function of valuation multiple expansion either.

Successful stock buyback programs are discussed at length. What is less talked about, however, is the enormous value destruction that takes place when they are done poorly. Ineffective buybacks are done routinely to offset stock option dilution whereas the true disasters occur when a company experiences a sudden meaningful and unsustainable increase in free cash flow. Executives fail to understand when the difference between when they could conduct large buybacks versus when they should.

Big Lots (BIG) is one such example. Over the past few years, the business has spent ~$600 million buying back stock at an average cost of $52/share. Fast forward to today and the market capitalization of the entire company is less than $250 million and trades for $8/share. Whoops! Big Lots was one of many companies that conducted horrendous share repurchases over the past few years. Plenty of other pandemic beneficiaries did the same thing after experiencing a sudden influx of excess free cash flow that they didn’t know what else to do with.

Prospective shareholders are not on the hook for past mistakes. But this kind of severe capital misallocation would give us tremendous pause when evaluating potential opportunities in these beaten down stocks, especially if the management team responsible for these decisions remained at the helm. Many of these stocks will no doubt do extraordinarily well over the next few years but sometimes investing is more about avoiding train wrecks than hitting home runs. To that end, we prefer to invest alongside management teams with a track record of shrewd stewardship of capital, even if these situations are not quantitatively the cheapest from a valuation standpoint.

LOOKING AHEAD

As previously discussed, the year-to-date S&P 500 performance has been driven by only a handful of stocks. Most equities are still well below all-time highs. Multiples are expanding faster than forward earnings estimates. Volatility keeps drifting lower, and the VIX is currently the lowest it’s been since March 2020. Market conditions like this tend to lull participants into autopilot, but we do not believe now is the time to be complacent.

Believe it or not, investor sentiment remains closer to panic than euphoria despite the strong rally, according to the Levkovich Index (Appendix D). This reinforces our belief that markets will trade in a long sideways band for quite some time. We anticipate the leadership gap to narrow and would prefer not to chase the expensive ten juggernaut stocks higher at this juncture. Rather, we are finding ample opportunities in the SMID-cap space.

Our biggest concern is the inverted yield curve which suggests economic pain may be on the horizon. Earnings declines are at the heart of every prolonged bear market. Whether that happens sometime this year or next remains to be seen. We cannot accurately predict the timing of economic cycles. Instead, our approach will be to gauge investor sentiment. Waiting for moments when participants are so optimistic that no price is too high, and the last incremental buyer capitulates. That’s precisely the moment we will want to be hedged.

Sincerely,

APPENDIX

Appendix A - Bloomberg

Appendix B – Barclays U.S. Equity Strategy – Food for Thought: It’s Lonely at the Top – June 9, 2023

Appendix B Continued – Barclays U.S. Equity Insights – Follow the Leader – June 12, 2023

Appendix C – Barclays U.S. Equity Strategy – Food for Thought: Dissecting the AI Rally – June 23, 2023

Appendix D – Citi Research – U.S. Equity Strategy – The PULSE Monitor – July 14, 2023