ONTARIO HOUSING MARKET

At What Point Is Housing Unaffordability Considered A Crisis?

August 10, 2021

Click here to download the PDF version

THE HOUSING MARKET: A CRISIS IF PRICES GO UP, A CRISIS IF PRICES GO DOWN

I have deliberately refrained from writing about the red-hot Canadian housing market thus far but feel like now is an appropriate time to offer my two cents, for whatever it’s worth. A good friend of mine passed along this Reddit post knowing it would be of great interest to me. Below is a screenshot edited to remove profanity.

To summarize, the poster is expressing his utter hopelessness for how he has been essentially priced out of the housing market. We recommend clicking the link and reading the comments posted by other users. It’s eye-opening. Before we get started, please do not misconstrue what this post is. I am not prognosticating about the direction of the housing market. Rather, I’m attempting to analyze potential long-term consequences that extend far beyond your property’s most recent appraisal.

FIRST-TIME HOME BUYER UNAFFORDABILITY

Finding comparisons in real estate is tricky because no two properties are exactly the same and sometimes renovations can increase the value of a home. But we’ve seen many instances where a place that sold 3-5 years ago was recently re-listed and sold again for 50-100% higher despite minimal work being done to the house.

Two-bedroom condos close to downtown will run you ~$900K and an average ‘starter home’ anywhere in Etobicoke will set you back at least $1.2 million. Even townhouses outside of the core (Vaughn, Port Credit, Oakville, etc.) typically cost $1.1 million or more.

To break down just how unaffordable this is for first-time home buyers, we are going to backwards solve for what level of income a couple would need to get their lives started. For the sake of the exercise, we can pretend property taxes don’t exist, monthly maintenance costs are covered by the tooth fairy, utilities are free, and nothing inside the house ever needs to be repaired. Let’s assume the buyers were avid savers during their early-to-mid 20s and scraped together $300K for a down payment. Am I being generous enough?

A mortgage for $900K boils down to ~$3.5K/month or $42K/year. Personal Finance 101 generally recommends that roughly one-third of annual income should be tied up in total living costs. Tripling this gets you to $127K/year in annual after-tax income. We’ll go ahead and assume this lovely couple is in the highest marginal tax bracket (54%) and pays a blended 35% income tax rate to use round numbers. Again, we’re ball parking here. That’s close to $200K in annual household income just to conservatively carry a $900K mortgage on a starter home.

You can play around with the numbers and maybe you’re comfortable spending more than one-third of your after-tax earnings on a mortgage payment. But regardless, carrying $3.5K/month is no small feat for those who are still relatively early in their career development trajectory.

Analyzing median household income puts into context just how high of a bar needs to be cleared to attain home ownership. The median after-tax income of Canadians was $62,900 in 2019, according to Statistics Canada. This number is skewed lower by seniors and skewed higher by professionals in their peak earning years, so again, we’re ball parking it here.

Either way it’s an almost unachievable goal for the vast majority of millennials today. Applying the one-third rule to a median after-tax income of $62,900 implies the mortgage would be $400K and the couple’s buying power would be roughly $750K. That is a pretty significant swing from what is needed to buy a ‘starter home’. But I’m sure they will fall in love with a very swanky one-bedroom apartment though.

NOT CONFINED TO PRIME DOWNTOWN REAL ESTATE

We could understand if rapid price appreciation were confined to prime real estate in downtown Toronto or even the broader GTA. But this is simply not the case. The user above described their area as rural. The user below describes a “relatively seedy area of Hamilton”.

How bad could this possibly be? These anecdotal instances are surely exaggerated, right? Well we quickly perused some listings in Thunder Bay that probably haven’t undergone significant renovations in decades. The average listing as of this morning appears to be around $1 million. For those of you not familiar with Ontario, here is its location on a map. According to Google maps, it’s a 15-hour drive.

PROXIMAL CAUSES

The obvious proximal causes, in no particular order, are (1) artificially low interest rates, (2) lack of housing supply, and (3) alleged money laundering through Canadian real estate. Again, I do not want to speculate on the degree to which each factor has impacted prices. Doing so is an impossible task given the lack of necessary available information and the complexity of the analysis. But more importantly, where society and the economy go from here simply matters so much more.

PAPER GAINS AND PRICED-OUT MILLENNIALS

Homeowners are generally unsympathetic towards the plight of the Priced-Out Millennial because they think they benefit from rising housing prices and, so long as the music keeps playing, life is good. The largest asset they own with the use of leverage keeps ticking higher and higher. No need to rock the boat.

That line of thinking only works if you focus on what benefits you immediately and disregard any potential long-term consequences from such rapid price appreciation. It’s my belief the perceived benefits from a rising tide are much higher than the actual benefits.

Higher successive appraisals may make homeowners feel like Mr. and Mrs. Moneybags today. On paper their net worth climbs, and they can probably re-finance the mortgage to buy fun stuff like boats and jet skis. Treating your home like an ATM can certainly make people feel a lot richer than they actually are. But, to an extent, this rise in net worth may not be all it’s cracked up to be.

Let’s assume property values doubled across the board overnight. You certainly made a killing on your home, at least on paper, but now what? Your property taxes going forward will roughly double. Insurance costs increase. But that’s okay, you can crystalize those gains and move somewhere else, right? Except you really can’t.

Every other option just got twice as expensive too, and the cost of moving (land transfer tax) just doubled as well. Relatively speaking, moving becomes a much less attractive alternative and it probably makes more sense to stay put. The end result is lower liquidity, less inventory on the market, and less volume of buying / selling taking place.

Homeowners that can effectively leverage their existing properties to purchase new ones will probably benefit the most, as that can be a productive way to compound capital. Few people are able to do this well though.

FAMILY FORMATION (or LACK THEREOF)

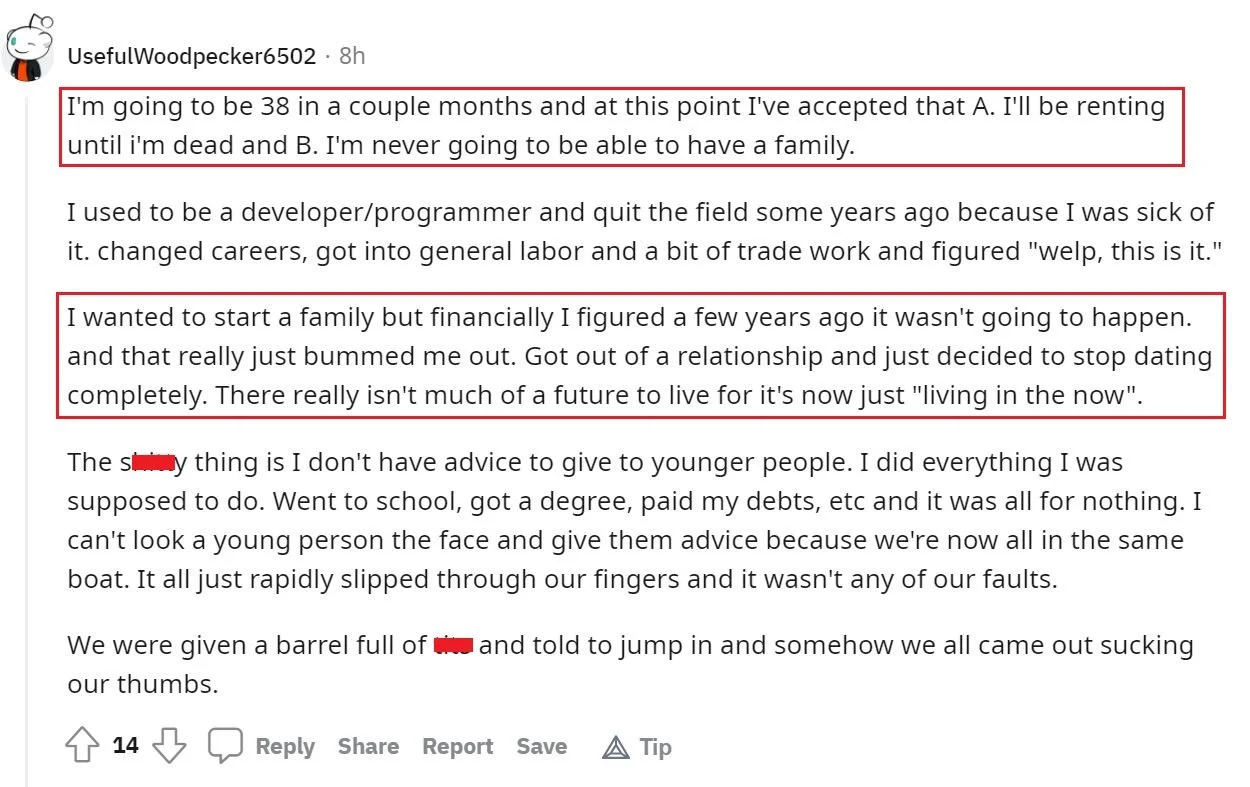

The benefits from gatekeeping the next generation out of the housing market are overrated and the long-term consequences from doing so are overlooked. It is one of the biggest issues facing Canadians today, but it doesn’t get nearly as much coverage as it should. The crux of the problem is this kind of extreme price appreciation sows the seeds of a pending demographic crisis. It’s virtually guaranteed at this point, barring mass immigration of course.

Demographic crises have profound long-lasting ramifications for an economy and a society. In my opinion, the economic boost received today from a red-hot housing market will ultimately be dwarfed by the corresponding economic drag this unusual price activity eventually causes.

Productivity growth and demographic changes are at the heart of sustainable economic growth. How can family formation possibly exist under these conditions? If millennials can’t afford houses, where are their hypothetical children going to live? If they can somehow manage to buy a small home, how are they going to afford to raise them?

Best-case scenario, family formation is severely delayed and worst-case scenario, it’s foregone entirely. Those who have kids will likely have fewer than those in the preceding generation. On balance, the average number of children per household will decline. What does that say about long-term economic growth?

TWIN CRISES

Canada is staring down the barrel of coinciding crises. A potential demographic crisis combined with gargantuan debt levels (both public and private, including under-funded pensions) is a precarious situation to be in. Reversing the damage isn’t so easy either.

Three options: (1) Grow our way out of the debt, (2) Inflate it away, (3) Default it away … or a combination thereof.

How can economic growth possibly occur under such conditions? Worsening demographics create a structural headwind and exorbitant tax rates disincentivize entrepreneurship in the first place.

Where do we go from here?

HOUSING MARKET HAS BECOME A MATTER OF NATIONAL SECURITY

My friends and I half-jokingly say the Canadian housing bubble has become so large that any perceived risk to its unabated continuation is considered threat to national security. Think about it. The social upheaval if the housing market were to drop 25%+ is unimaginable. The entire country is leveraged long one asset class for better or worse.

Making matters more complicated, in Canada mortgage rates can only be locked into a maximum five-year term. That means the interest rate on ~20% of outstanding mortgages are reset every year. Can the Bank of Canada even raise rates meaningfully against this backdrop? Doing so would pose a significant risk to the housing market.

Before attempting to normalize rates (whatever that means anymore), the rules will probably need to be adjusted so homeowners can lock in a fixed rate over the entire life of the mortgage. Raising rates would cause home prices to decline quickly while one-fifth of monthly mortgage payments would suddenly become more expensive. Taking a huge haircut on the equity value of your largest asset while simultaneously paying more money to carry it would be nothing short of a catastrophe.

It begs the question. Can the housing market be allowed to fail? If history is any indication, politicians and central bankers will pull out all the stops to kick the can down the road as far as possible while minimizing the concerns from those negatively impacted by such policy decisions.

SOCIAL TENSIONS AND GENERATIONAL DIVIDES

Lately we have seen the collapse of the political center while the divide between the far left and far right continues to grow. The left / right strife is already beginning to morph into an upper / lower class divide. Going forward I can easily envision this class divide evolving into a generational divide. In fact, this type of progression is my current base case until something substantial changes.

People simply need a sense of hope and purpose. It’s engrained into human DNA. Taking that away from people is unnatural. The pursuit of happiness cannot truly exist if people believe its impossible to get ahead in life. Without it, society could succumb to a destructive sense of nihilism that shrinks the size of the pie for everybody.

Economics always involves a trade-off. Just because certain costs can remain hidden doesn’t mean they don’t exist. Pushing present problems into the future doesn’t erase them. Costs can be spread around or transmuted through time but can never be eliminated entirely. There are no free lunches. The future eventually becomes the present.

WHAT NOW?

The housing market has really painted itself into a corner from which there is no easy solution – only trade-offs. I don’t profess to have any magic bullet formula or magic wand. But it’s important to evaluate economic alternatives by comparing pros and cons simultaneously while placing more emphasis on potential long-term outcomes that extend far beyond the next election cycle.