RETURN OF THE STONKS

Meme-Stock Fever Pitch Hitting Highs (Again)

June 8, 2021

Click here to download the PDF version

THE SECOND COMING OF THE MEME STOCK MANIA

We initially didn’t want to write about meme stocks rising from the dead but seeing CLOV +110% intraday was the straw that broke this camel’s back, and now we can’t help ourselves. You’re probably thinking ‘meme stocks were so five months ago’ and you’re right. But, much like the Montreal Canadiens, they made one hell of a comeback.

Most notably AMC Entertainment (AMC), GameStop (GME), Clover Health (CLOV), and BlackBerry (BB) are all surging despite a total absence of any material positive fundamental developments. We can’t think of another instance of widespread bubbles inflating, collapsing, and then re-inflating again with such vigor so shortly thereafter. We feel this kind of market activity is symptomatic of much deeper problems that cannot be adequately addressed via this medium.

Instead, we’ll explore how AMC took advantage of Mr. Market’s irrationality.

THE AMC SAGA

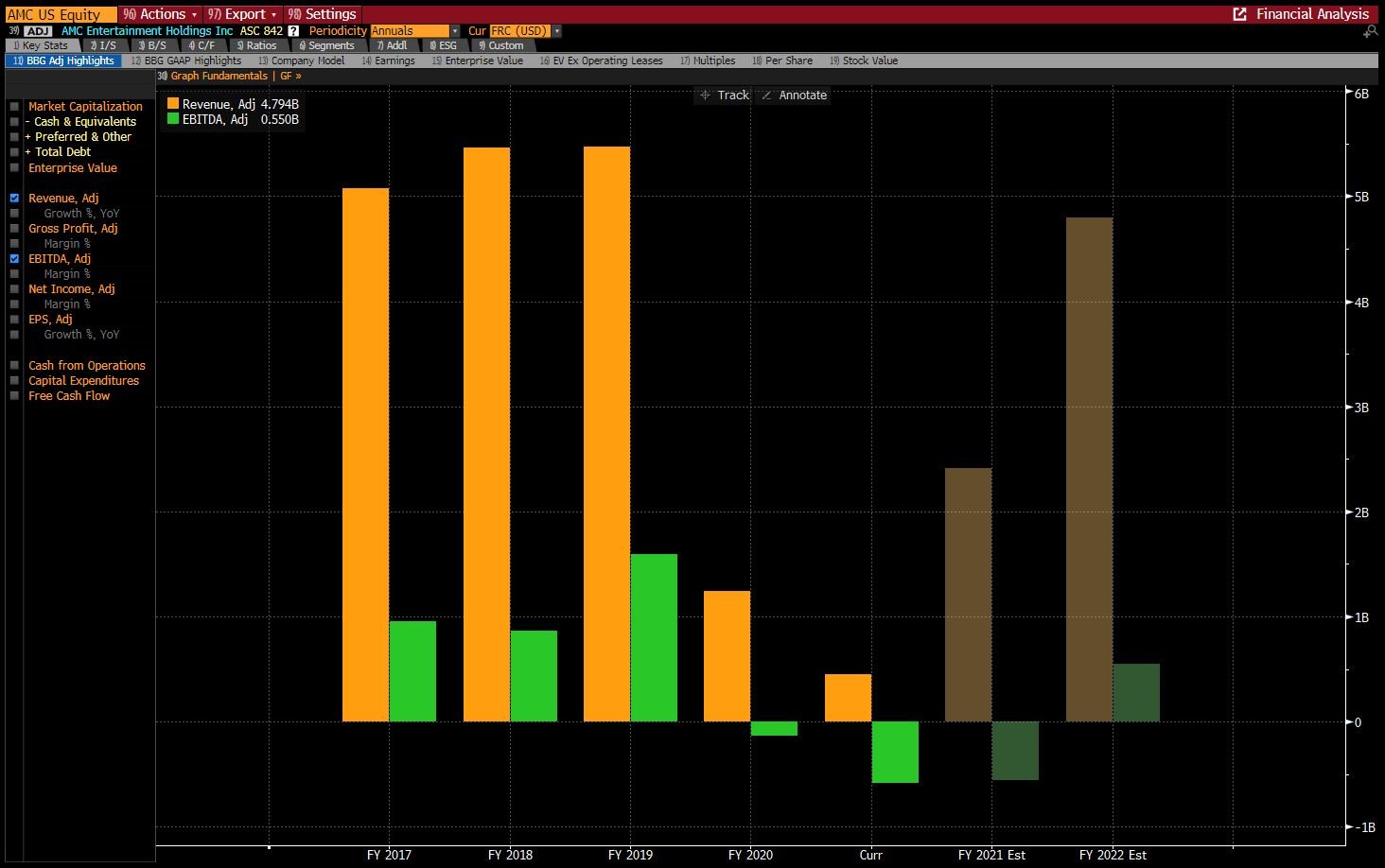

AMC shuttered its theatres when the pandemic started, and analysts are currently forecasting it will take until at least FY23 to reach historical peak revenues. In fact, the long-term economics of owning and operating theatres may be permanently impaired with the accelerated adoption of direct streaming services. We would not be surprised if industry wide revenue per theatre never hit highs again unless significant changes to the business model are made.

The bonds have traded well below 100 cents on the dollar, suggesting solvency risk was and still is a real possibility. Creditors recognized business fundamentals were horrible, even before the pandemic, and the capital structure was saddled with a crippling debt load. But none of those minor inconveniences stopped the management team from playing the cards they were dealt.

AMC took the figurative phrase ‘catering to retail investors’ and applied it quite literally, offering free popcorn and other perks to shareholders (read: gamblers) as a gesture of appreciation. In conjunction with this increased retail enthusiasm, the management team has issued enough stock to roughly quintuple the share count.

Below is an excerpt from an excellent Bloomberg article written by Matt Levine (emphasis added).

Some of that was desperation: In late 2020 and early 2021, with theaters closed due to pandemic and debt pressing on AMC, it diluted its shareholders by selling tens of millions of shares near its all-time-low stock price. Some of it, now, is hilarious joyful opportunism: In June 2021, with an army of retail “apes” enthusiastically bidding up the stock, it will sell millions of shares at its all-time high. In the first quarter of 2021, AMC sold a total of about 187 million shares in at-the-market offerings, for gross proceeds of about $597 million. That’s an average price of about $3.19 per share. Now it is offering 11.55 million shares, roughly 6% of what it sold in the first quarter, worth $722 million at yesterday’s close. It will get more money from this offering, for 6% as much stock.

AMC’s stock price was roughly $7.00 pre-pandemic and $6.45 exactly one year ago. Today the stock is trading at $55. While the increase in share price is perplexing, the increase in market capitalization is even more preposterous. While the stock is (only) up 8.5x, the market cap is actually up 41.8x.

Below is an amusing excerpt from the regulatory filing associated with the secondary offering. AMC corporate lawyers are practically begging you not to buy the stock. These are not routine boiler plate legal disclaimers. This is the kind of verbiage you would find from a company that actually expects to get sued in the future.

But I digress. Instead of rehashing the craziness that a million other people have already written about, we’ll explore the circumstances in which stock price can actually dictate fundamentals.

REFLEXIVITY BETWEEN STOCK PRICE AND INTRINSIC VALUE

There are no shortage of educational resources discussing how business fundamentals dictate stock price. Revenue growth, margins, free cash flow, discount rate, yada yada. But this foundational relationship can occasionally work in reverse. We feel this is an interesting time to highlight the following concept: as much as fundamentals dictate stock price, in some instances, stock price can dictate fundamentals.

Businesses can generally function independent of what Mr. Market perceives its intrinsic value to be on any given day. Two notable exceptions, however, are when companies tap into the capital markets or conduct M&A.

Issuing equity at an elevated stock price means existing shareholders are diluted less than they otherwise should be, increasing the underlying intrinsic value. For instance, AMC issued shares to the public over the past year and half in the ~$3 range and now, because of the meme stock mania, existing shareholders were diluted by a factor of ~17x less than they otherwise should have been. That adds up to a pretty meaningful number. This kind of magnitude is obviously a rare occurrence, but still.

On the flip side, if a business is perceived to be dead, issuing stock to remain solvent may not be possible. In which case the fate of the business is a self-fulfilling prophecy. The moral of the story is perception matters. Having a management team capable of gaming the system (whether rightly or wrongly) can impact intrinsic value and, in extreme circumstances, can be the difference between dilution and Chapter 11.

The other instance in which this relationship can work in reverse is M&A. Companies will use their inflated stock price as currency when conducting acquisitions. This kind of financial engineering can work well for serial acquirers that benefit from a premium multiple since investors anticipate accretive future acquisitions.

Problems occur when scam businesses manipulate their stock price higher with overly promotional press releases, or smoke and mirrors, and then use their stock as currency to acquire a real legitimate business. The fake it ‘til you make it approach carries risk when shorting earlier stage story stocks led by executives with ambiguous moral compasses.

Short Selling and Steam Rollers

At the risk of sounding like a broken record, the second coming of the meme stock mania is just another example of why short selling today feels like picking up nickels in front of a steam roller. AMC moved from $10 to $55 in less than one month on no actual fundamental news. Any given short position is almost guaranteed to have a potential return profile with a very heavy negative skew. Central banks have turned financial markets into a casino, and the façade of being anything more serious than a place to recklessly gamble stimmy checks is quickly fading away.