TALE OF THE TAPE

Market Structure vs. Fundamentals

May 27, 2021

Click here to download the PDF version

WHEN MARKET STRUCTURE TRUMPS BUSINESS FUNDAMENTALS

Today, stock prices have as much to do with market structure than they do with underlying business fundamentals and valuation. The pervasive shift toward passive investing (read: rules-based investing) over the years had led to some staggering market distortions. Combine that with unprecedented central bank policy and prices have never been more obfuscated.

Going forward, these distortions will likely become more pronounced (especially for faux-EV, ESG, AI, cryptocurrency, 3D printing, space exploration companies, etc.) until the current paradigm comes to an end. As an aside, the shift to passive investing presents profound corporate governance dilemmas and conflicts of interest. But for the purposes of this post, we intend to explore situations where market structure dictates price action more than fundamentals, causing prolonged dislocations between price and intrinsic value.

VOTING MACHINES AND WEIGHING MACHINES

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – Ben Graham

A stock only ever trades for exactly its intrinsic value at two points in time: bankruptcy or a takeover. Intrinsic value acts as an anchor and the quoted market price will oscillate around that point, sometimes overshooting and sometimes undershooting. As more time passes, the gravitational pull of a stock’s intrinsic value will cause any interim dislocations to become smaller, improving price efficiency. Or that’s the idea anyways.

The reality is that the “short run” Ben Graham refers to can persist for lengthy periods of time, spanning entire paradigms in some instances with no end in sight. Gravity is inescapable eventually though. A plane can fly over long distances but, at some point, will run out of gas. The same principle holds true for stocks prices. The ‘intrinsic value’ gravitational pull will always prevail… Eventually.

Example 1: WDFC

WD-40 Company (WDFC) is the poster child of market structure trumping fundamentals and valuation. The stock is relatively illiquid (low trading volume relative to market cap), has a tight float (held predominantly by passive vehicles), and has a constant bid underneath the stock price as long as those ETFs experience net inflows and the management team buys back shares.

BCAAP investors (buy compounders at any price) love the stock because the business generates high ROE and ROIC, but completely disregard the inconvenient fact the company cannot possibly reinvest profits back into the business at the same rate of return. If a “compounder” cannot deploy free cash flow back into the business at a high incremental ROIC, is it really a compounder?

Below illustrates WDFC’s journey over the past few years as the fundamentals remained fairly stagnant, yet the stock price has become more detached from the underlying business as time passes. Key metrics such as revenues, EBITDA, net income and margins have remained flat while 20x EBITDA turned into 32x EBITDA, and 32x EPS turned into 44x EPS.

Example 2: BMI

Badger Meter (BMI) is another stock with stagnant underlying fundamentals but has disproportionately benefitted from a high percentage of passive ownership. Again, key metrics have largely gone nowhere while 15x EBITDA became 25x EBITDA and 27x EPS became 47x EPS. No surprise that the top three shareholders are all passive vehicles and combine for 33.4% of shares outstanding.

Example 3: PRLB

At this point you’re probably wondering if you can design a low-cost investment vehicle to buy stocks with the same characteristics because, on the surface, it seems like a magic winning formula. All you have to do is screen for expensive stocks with high ETF ownership, underwhelming growth expectations, flat margins and voila – you have alpha. Quickly write some code so the vehicle runs itself and you can spend four days a week on the golf course.

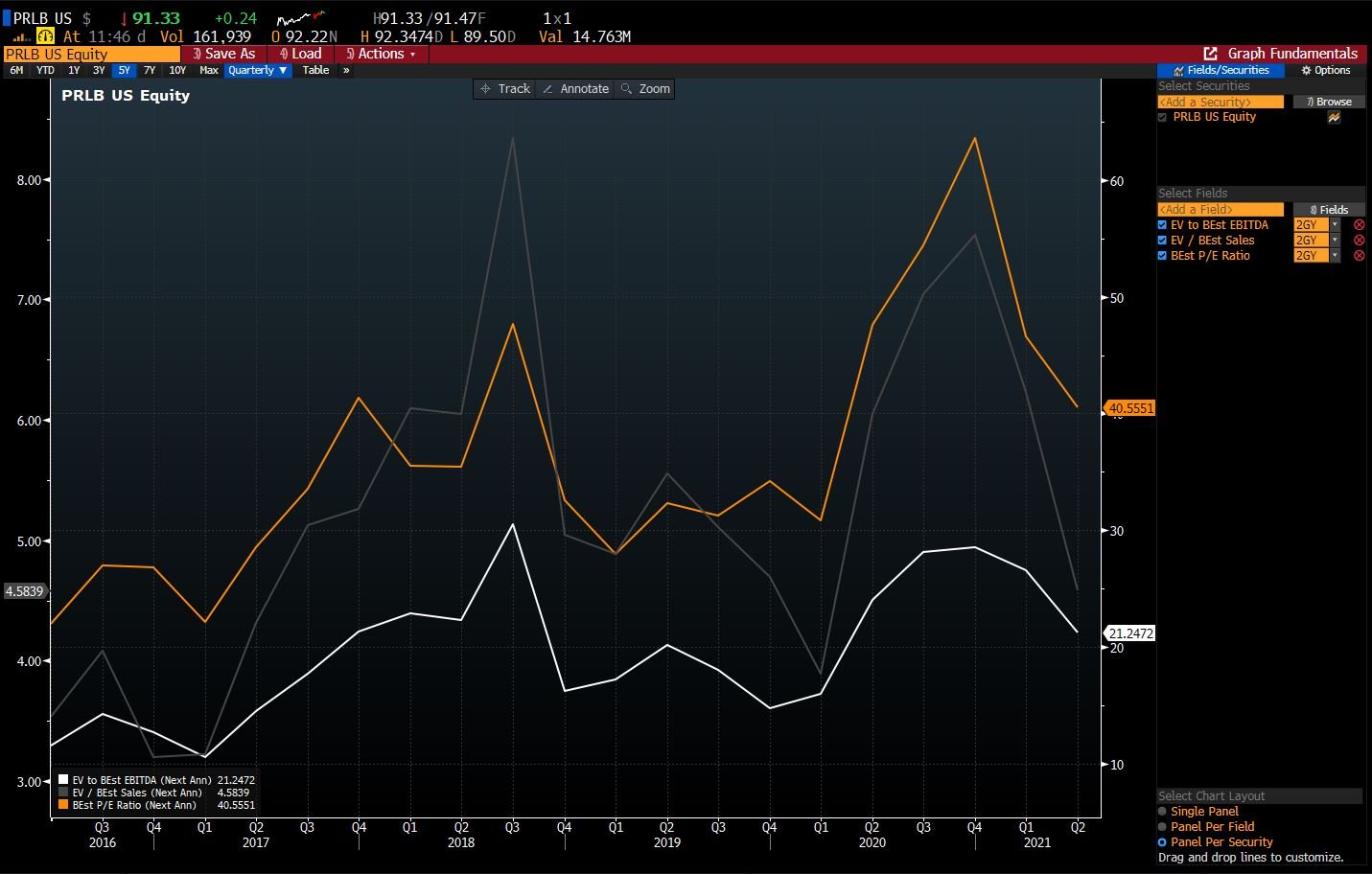

Proto Labs (PRLB) fits the bill. The company’s organic growth has been declining for years, the margin profile is in the midst of a tailspin, and the shares are predominantly owned by passive entities. I know what you’re thinking – all bullish signs. Six months ago, you might have sold all your Dogecoin and GameStop shares to pile into this inevitable rocket ship. But PRLB is a perfect example of what happens when these wonderful tailwinds quickly turn into ugly headwinds.

Initially things went as you would expect. PRLB went from 11x EBITDA to 29x EBITDA at the peak, and 22x EPS to 64x EPS at the peak. But in Q1 2021, Ark Innovation ETF (ARKK), a large shareholder, reduced its position size and then subsequently experienced significant net outflows in Q2 2021. In fact, the rise of PRLB correlates pretty closely to the net inflows ARKK received during mid-2020 to February of this year. The reflexivity that benefitted shareholders on the way up became the death knell on the way down.

Source: William Blair Equity Research - May 21, 2021

Source: William Blair Equity Research - May 21, 2021

SHORTING ON VALUATION ALONE

A quick word on valuation shorts. This kind of dynamic makes shorting solely on valuation incredibly challenging. Arguably, all of these businesses were overvalued when their ascent began and then the stocks spent years becoming even more expensive. It helps to have another leg to the thesis. Melting ice cube, accounting shenanigans, anything.

“After all, twice a silly price is not twice as silly; it’s still just silly.” – David Einhorn

Timing and risk management are the two most difficult aspects to shorting stocks. It helps to have potential catalysts in mind when initiating positions to avoid taking constant losses while your position perpetually drifts higher. At some point, the intrinsic value gravitational pull will prevail, but your solvency may not.